maine excise tax refund

Environmental Fees Ground Water Tax - offsite. Maine Revenue Services temporarily limits public access PDF Maine Revenue Services Announces Limited Telephone Tax Payer Assistance PDF Maine Tax Alert - May 2022 PDF MRS Warns Employers of Tax Phishing Schemes PDF.

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

TaxAct does not support Form 8849 Claim for Refund of Excise Taxes.

. The state excise tax on gas in maine is 30 cents per gallon of regular gasoline. With this implementation and each following implementation the Maine Tax Portal will enable online filing for all tax types administered by Maine Revenue. According to the instructions on the Maine website you can take a deduction on your Maine tax return for most of the itemized deductions that you take on the federal return and this would include the personal property tax that you paid.

The state collects about 25 million in CFET tax each year. Tax payments for these tax types can be made now via the Maine Tax Portal MTP at. Choose your filing status and then enter the refund amount you are claiming.

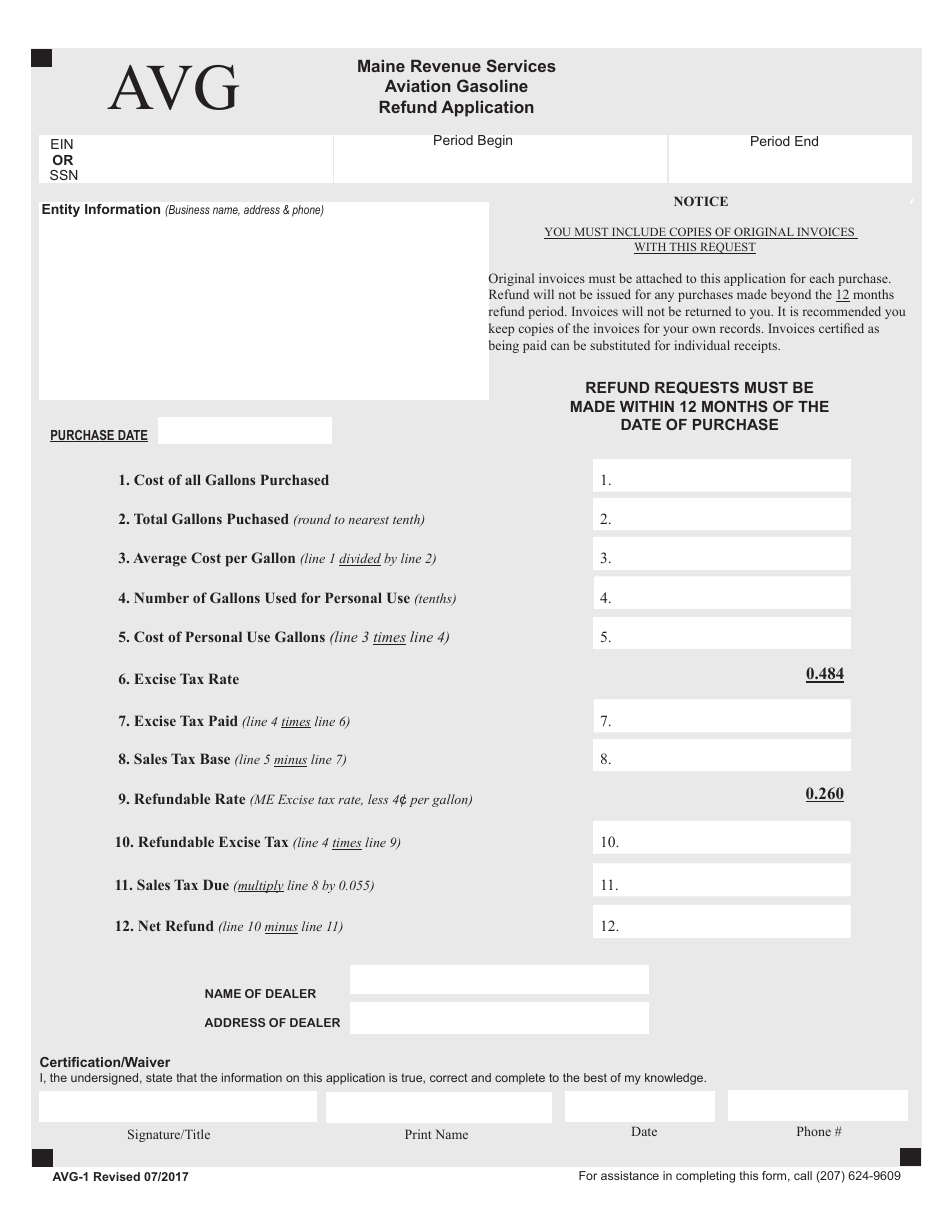

Maine Excise Tax Refund How Should Maine Fix Its Transportation Funding Shortfall Maine Policy Institute - There are no cash refunds on unused excise tax for retired vehicles. Requests for a refund must be filed within 12 months of the date of purchase of the fuel. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the excise tax provides evidence that the registration has been voluntarily surrendered and cancelled under Title 29-A section 410.

Maine Excise Tax - References. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. Missing session attribute LoginForm of type IstLoginModel salestax150 - PROD.

Municipal Services and the Unorganized Territory. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Welcome to Maine Revenue Services EZ Pay.

Political Subdivision Instructions PDF Affidavit for Assignment of Refund PDF Note. Excise Tax is an annual tax that must be paid prior to registering a vehicle. SalesUse.

Tax Return Forms NOTE. A transfer fee of 3 is due to the municipality. For electronic filing of the form according to the Instructions for.

Maine Department of Revenue issues most refunds within 21 business days. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation. 1 If a motor vehicle is sold or lost the motor vehicle owner may be entitled to a credit for the excise tax paid on the sold or lost vehicle against the excise tax due on a subsequent vehicle.

WHAT IS EXCISE TAX. If the problem persists please call Maine Revenue Services support staff at 207 624-9693. Individual Income Tax Return.

A refund of excise tax may be available on purchases of gasoline or diesel purchased and used by a government agency or political subdivision of this state 36 mrs. Maine taxpayers now have the option to pay various tax payments online quickly and easily. The amount of the refund must be the percentage of the excise tax.

Enter refund amount as whole dollars only dont round just drop the cents. Below are the links to these forms if you wish to complete and paper file them. Individual Income Tax 1040 Refund Status Lookup Results.

The Maine Tax Portal will provide improved functionality and access for Maine people and integrate all taxes administered by Maine Revenue Services into a new single online system. Political Subdivision Refund Request Form. This is a separate return from the individual tax return on Federal Form 1040 US.

Please enter the primary Social Security number of the return. Excise Tax is an annual tax that must be paid prior to registering your vehicleExcept for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise TaxExcise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle boat or camper trailer on the public ways. Refund information is updated Tuesday and Friday nights.

You may check the status of your refund on-line at Maine Department of Revenue. FAQ about Coronavirus COVID-19 - Updated 472021. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Incentives may exist allowing certain state of federal excise taxes to be refunded on goods bought for specific uses but such incentives change frequently. Any change to your refund information will show the following day. Form 8849 - Claim for Refund of Excise Taxes.

While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non-refundable. Narratives IFTAIRP Refund Programs. Creditrefunds of excise tax.

Credits and refunds of excise tax are allowed as follows. New Search Exit Application. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Commercial Forestry Excise Tax Return. A 55 sales tax. You can start checking on the status of your return within 24 hours after they have received your e-filed return or 4 weeks after you mail a paper return.

The state valuation is a basis for the allocation of money. Individual Income Tax 1040 Refund Status Lookup Results. There are about 750 accounts including over 9 million taxable acres.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. Withholding and Unemployment Contributions 941ME and ME UC-1 Withholding Tables and Annual Reconciliation W-3ME. Blueberry Potato Mahogany Quahog and Railroad Excise Taxes.

Please enter the primary social security number of the return. RefundStatus120 - PROD. Requests filed after the 12 month period will be denied.

It says car registration isnt tax deductible in Maine. I paid excise tax on 2 vehicles. The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor or wine caused to be destroyed by a supplier as long as the quantity and size are verified by the bureau and the destruction is witnessed by an authorized representative of the bureau.

The Property Tax Division is divided into two units.

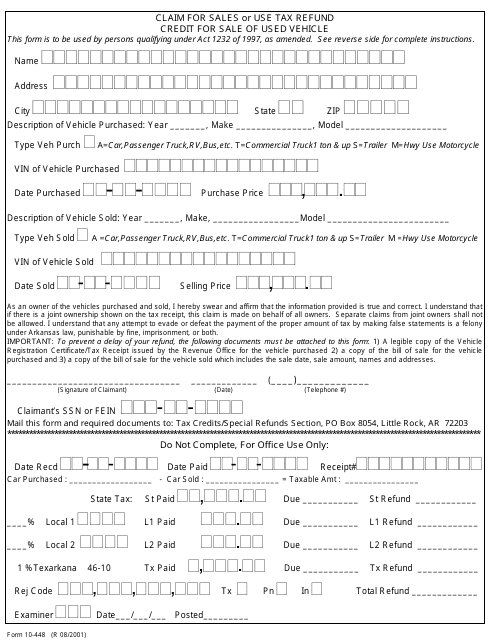

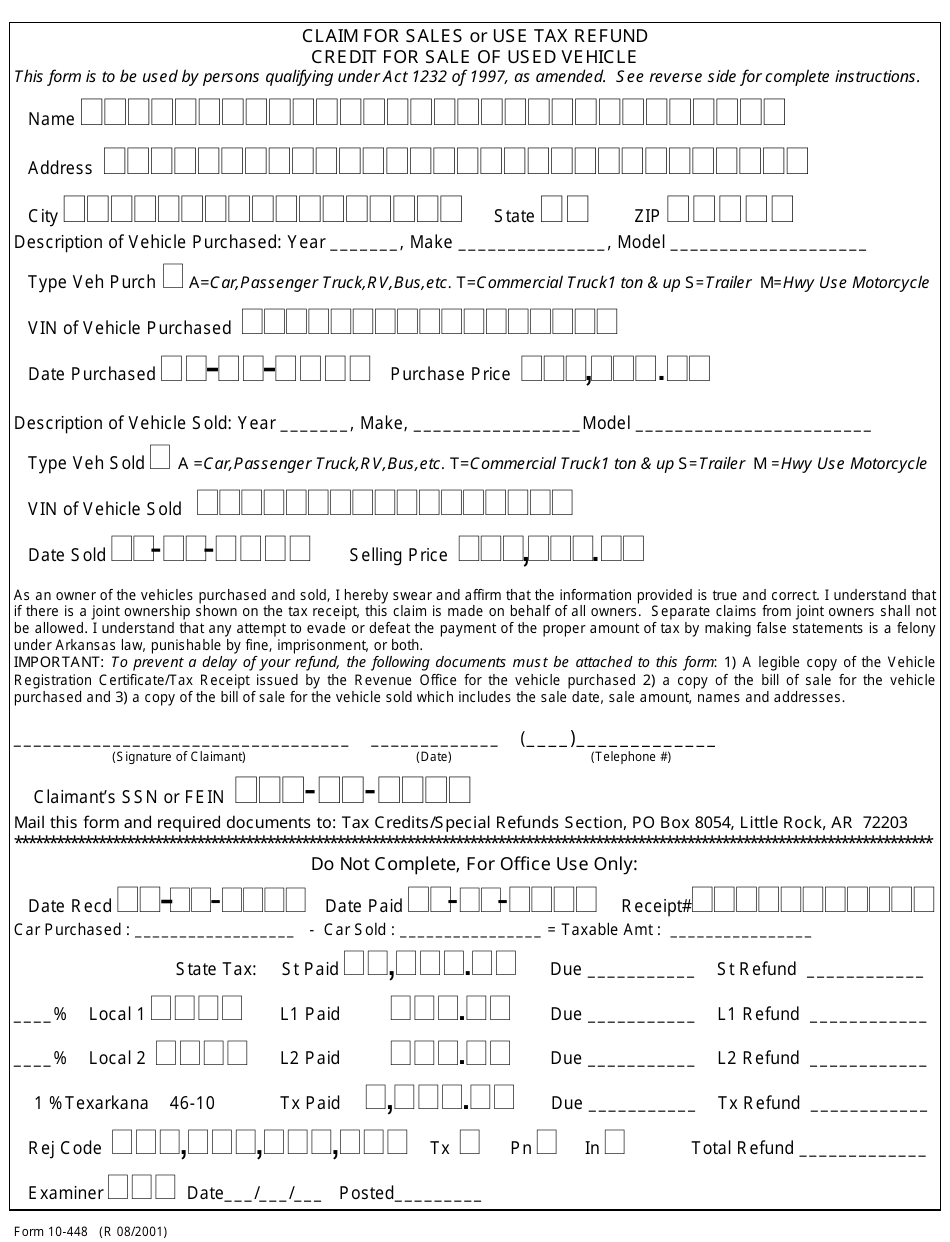

Form 10 448 Download Printable Pdf Or Fill Online Claim For Sales Or Use Tax Refund Credit For Sale Of Used Vehicle Arkansas Templateroller

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Massachusetts Enacts Elective Excise Tax For Pass Through Entities Albin Randall And Bennett

Form Avg 1 Download Fillable Pdf Or Fill Online Aviation Gasoline Refund Application Maine Templateroller

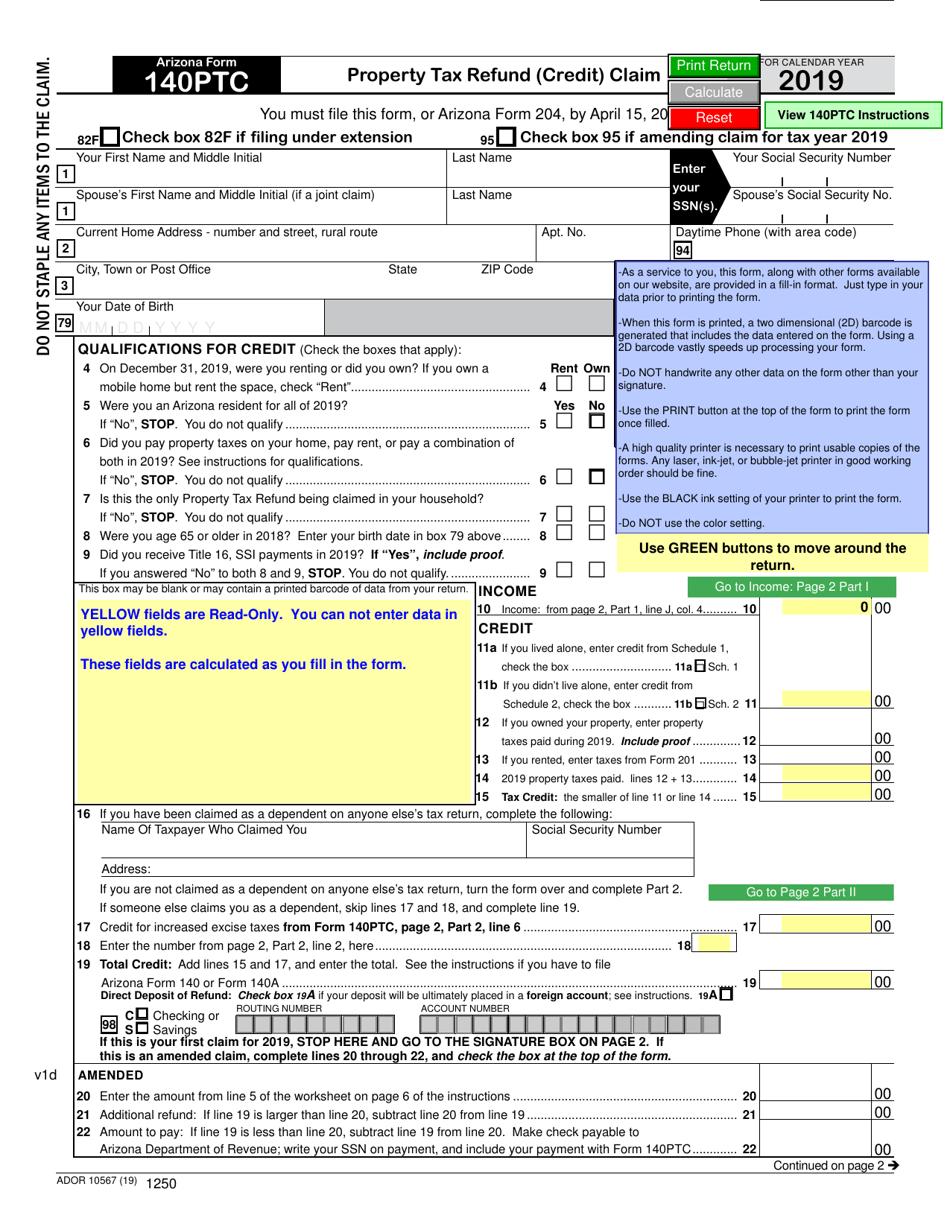

Arizona Form 140ptc Ador10567 Download Fillable Pdf Or Fill Online Property Tax Refund Credit Claim 2019 Arizona Templateroller

Form 10 448 Download Printable Pdf Or Fill Online Claim For Sales Or Use Tax Refund Credit For Sale Of Used Vehicle Arkansas Templateroller

Maine Online Medical Marijuana Card Service Veriheal Me

Form Avg 1 Download Fillable Pdf Or Fill Online Aviation Gasoline Refund Application Maine Templateroller